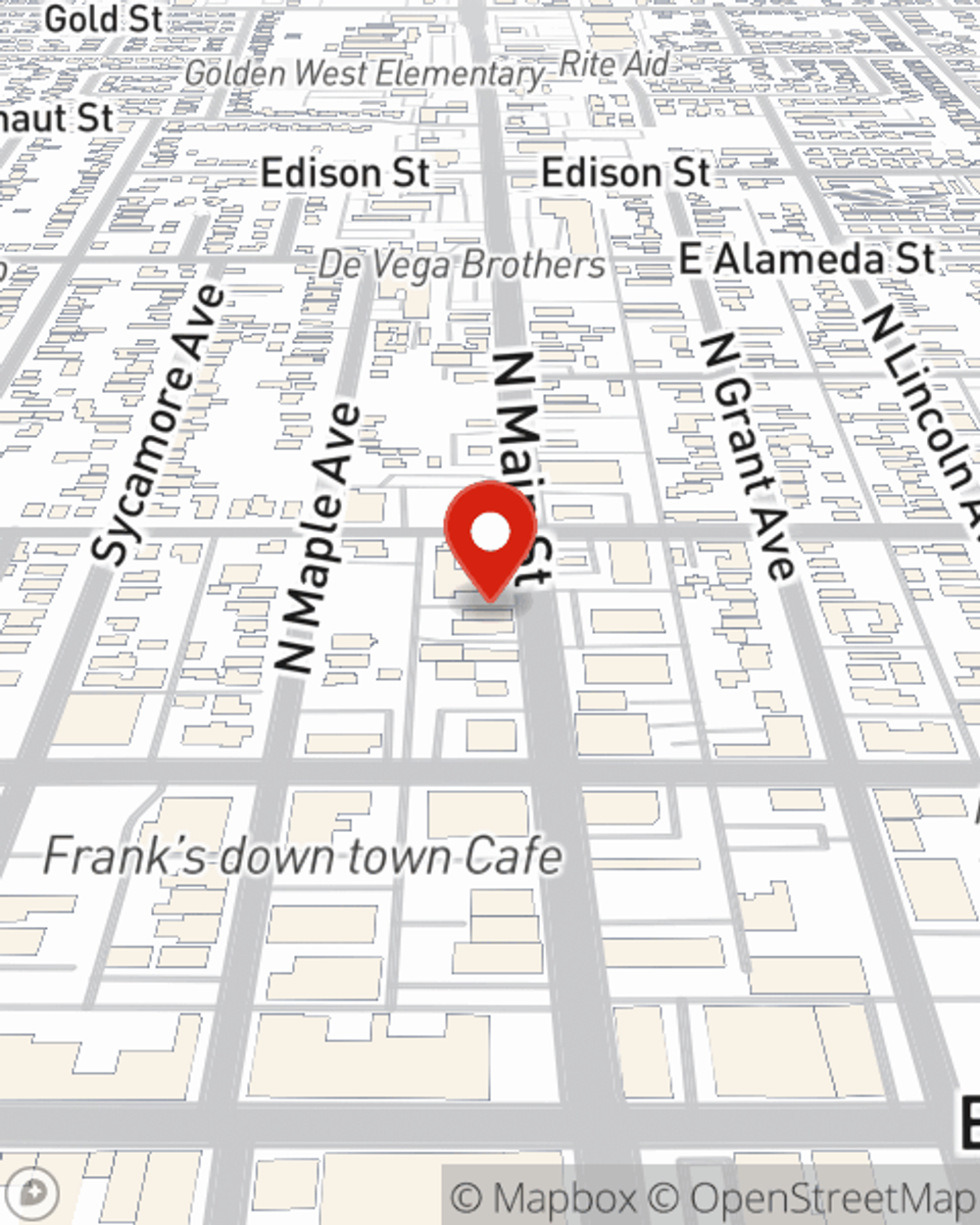

Homeowners Insurance in and around Manteca

Looking for homeowners insurance in Manteca?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Being a homeowner isn’t always easy. You want to make sure your home and the possessions in it are protected in the event of some unexpected damage or loss. And you also want to be sure you have liability insurance in case someone stumbles and falls on your property.

Looking for homeowners insurance in Manteca?

Help protect your home with the right insurance for you.

Protect Your Home Sweet Home

If you're worried about what could go wrong or just want to be prepared, State Farm's terrific coverage is right for you. Constructing a policy that works for you is not the only aspect that agent Lucy Moreno can help you with. Lucy Moreno is also equipped to assist you in filing a claim when troubles do come.

Now that you're convinced that State Farm homeowners insurance should be your next move, call or email Lucy Moreno today to learn more!

Have More Questions About Homeowners Insurance?

Call Lucy at (209) 823-7121 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

A quick review of laundry safety tips

A quick review of laundry safety tips

Laundry safety rules and tips including ways to prevent fire, poisoning, injury and other accidents.

Lucy Moreno

State Farm® Insurance AgentSimple Insights®

Extension cord safety: What to do and what to avoid

Extension cord safety: What to do and what to avoid

An extension cord is handy to have in the home or office, but without caution it can become a fire hazard. Here are tips for using an extension cord safely.

A quick review of laundry safety tips

A quick review of laundry safety tips

Laundry safety rules and tips including ways to prevent fire, poisoning, injury and other accidents.